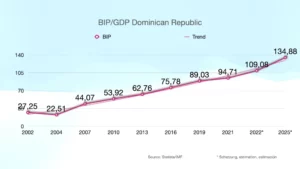

1. Positive development of the Dominican economy even after the pandemic

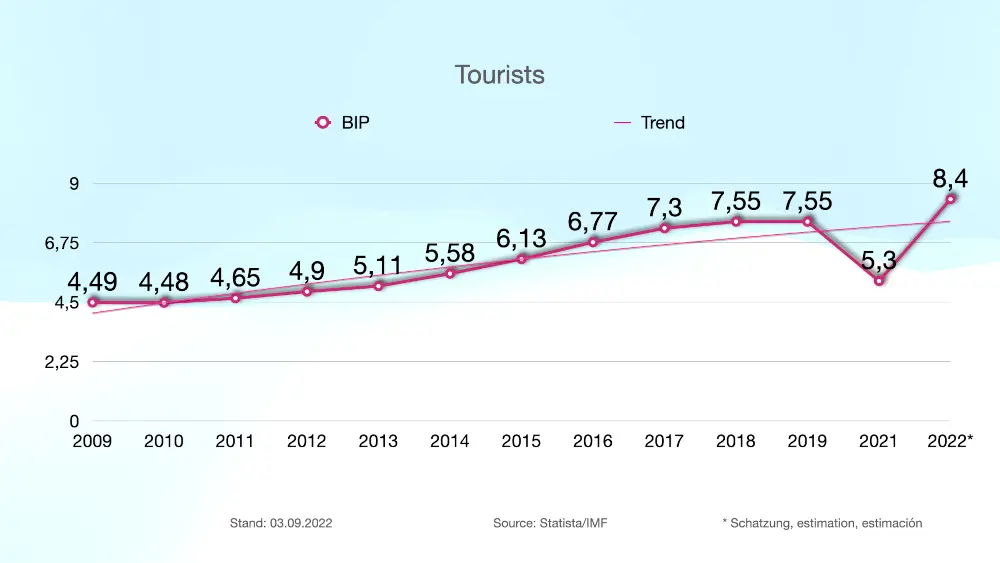

To invest in the Dominican Republic is a perfect idea, because “The Dominican Republic is one of the fastest growing economies in Latin America” (source: German Society for International Cooperation)1. This, not least due to an extremely rapid recovery in tourism with new record numbers, gives positive prospects, in contrast to the current development in Europe. Europe and especially Germany are in the focus of the global negative development, the DomRep is not. This offers potential, especially for those who decide quickly, thanks to the resulting increase in planning security.

In addition, there is a more stable development of the dollar compared to an uncertain development of the euro. The picture of the euro currently offers few positive prospects. The gap between the dollar and the euro has been steadily widening for almost 15 months. At the same time, the inflation rate in Europe is currently 9.1% on average (source: Statista/09.2022), while that in the DomRep is 8.76%, the forecast is falling again. You can find out more about the economy here.

2. Independence from European decisions

Individual EU countries will increasingly lose their independence as long as they remain in the EU. Current developments are increasingly showing a tendency for legislation at European level to specify what is then to be implemented in the countries. As a result, it is increasingly no longer about the well-being of a country, but about the strategic development of Europe. It can also currently be observed that countries like Germany in particular will specifically suffer from these developments. The DomRep offers an excellent alternative for this insecurity, as it is showing a development that contrasts sharply with European insecurity – falling poverty, falling violence and rising GDP as well as investments in infrastructure such as the massive expansion of the Manzanillo Port transshipment port. Regardless of whether it is a short, medium or long-term perspective, the DomRep performs above average everywhere.

Individual EU countries will increasingly lose their independence as long as they remain in the EU. Current developments are increasingly showing a tendency for legislation at European level to specify what is then to be implemented in the countries. As a result, it is increasingly no longer about the well-being of a country, but about the strategic development of Europe. It can also currently be observed that countries like Germany in particular will specifically suffer from these developments. The DomRep offers an excellent alternative for this insecurity, as it is showing a development that contrasts sharply with European insecurity – falling poverty, falling violence and rising GDP as well as investments in infrastructure such as the massive expansion of the Manzanillo Port transshipment port. Regardless of whether it is a short, medium or long-term perspective, the DomRep performs above average everywhere.

3. Less impact of the European energy crisis

The most important point is of course the lack of winter. Even in winter times, the temperatures don’t go below 19 degrees, so there are no heating costs on the island all year round. In addition, electricity prices are much lower than in Europe. Gasoline costs (as of September 2022) are around US $1.45/litre. Due to the traditionally predominant supply of energy sources from the American region, there is no dependence on Eastern or Arab suppliers.

The most important point is of course the lack of winter. Even in winter times, the temperatures don’t go below 19 degrees, so there are no heating costs on the island all year round. In addition, electricity prices are much lower than in Europe. Gasoline costs (as of September 2022) are around US $1.45/litre. Due to the traditionally predominant supply of energy sources from the American region, there is no dependence on Eastern or Arab suppliers.

4. High appreciation of real estate investing

All these parameters result in an extremely positive prognosis for the increase in value of your investments, especially your real estate. It doesn’t matter whether you use them yourself or rent them out. Especially in the case of the latter, the generally positive economic development on the one hand and the excellent development of tourism on the island on the other hand play a very important role. In order to be able to use this potential, thanks to the “IDAMAR Family” you don’t have to worry about anything on site.

All these parameters result in an extremely positive prognosis for the increase in value of your investments, especially your real estate. It doesn’t matter whether you use them yourself or rent them out. Especially in the case of the latter, the generally positive economic development on the one hand and the excellent development of tourism on the island on the other hand play a very important role. In order to be able to use this potential, thanks to the “IDAMAR Family” you don’t have to worry about anything on site.

5. State guarantee that no expropriation is possible

While in Europe, which few people know, the possibility of state expropriation is legally manifest in most countries2, people who invest in the DomRep receive a state promise that their land cannot be expropriated. So you can lean back and concentrate yourself on seeing your invest growing.

Footnotes

- https://www.giz.de/de/weltweit/72073.htm

- Germany: Constitutional law, Art 14, Abs. 3